Move over the "bear" and "bull", here comes the "giraffe"!

Of course, I am not talking about the real giraffe here, I am referring to the owner of local financial blog, Giraffe Value (since he like to remained anonymous for the time being, let's call him Giraffe then ;-)). I first chanced upon Giraffe's blog a couple of months ago and noticed that most of his posts are very informative and easy to digest (suitable for newbies).

Subsequently met him once in one of the financial bloggers gathering at

BigFatPurse premise and chat with him for a while. Found that he is a very hardworking and humble young chap with ambitions and dare to dream big.

Without further a do, let's start the interview proper and read on.... (I believed this is the longest post in my interview with bloggers series) :

Q1 : Can you give us an introduction about yourself?

A1 : I'm GV, not a real name. I'll show my real identity some day in the future as I'm still going to workshops and seminars and I don't wish anyone to recognise me. It’s funny because I heard instances where organizers stop bloggers from sitting in their workshop.

My career has been quite complex so far. A little back story here, I dropped out of ITE, made it to part-time private diploma while I was in NS. Worked as a debt collector right after and then made it to ACCA.

After graduated, I realized the golden age of accounting is over. And I was lucky to land a job in Apple as a payment specialist in their online store. Then I jumped to a prop trading firm as a day trader, it didn’t turn out well. I wasn’t making any money as it was based on P&L. There was no basic, so I left, and joined an AU listed metal trading company as a trainee trader. It was a Chinese family-style management culture, I didn’t learn much during that period, and I felt I was simply just collecting salary and wasting time.

So instead of looking for another job which I felt it was a risk that may lead to another time wasting job. And I thought maybe I can do something on my own. Because I would not want my success and life to depend on others or chance, but myself. So I knew I had to quit and I did.

After about six months of hustle, I was cash-strapped and with insurance expenses looming. So I took up a job in a financial education firm. So here is where I am now. Really lucky that I am now in an environment where I have the exposure of business and investment. And most important of all I have the time it needs to achieve what I set up to do.

The result of my effort has paid off quite well on my past two creations. That’s an interesting thing about the world. It doesn’t care what you do, how you do and how passionate you are. It just cares one thing: you get it right and you get the right result. I have not seen money’s result(yet). But I think I’m not too far off. Some ideas have to be validated first before knowing that I’m on the right track. So we shall see...

You know there are often times when people talk about life it often goes like this: study hard, get a good job, save some money, watch descendants of the sun after work, get married some day, then perhaps invest some money. Retire where you are finally financially independent, that sort of thing. It’s like there’s a life’s travelator built for you to stand still so that it gets to where it was built for. All advices you get are usually revolved around these areas. People will tell you this is how the way it is, so just stand still and don't try to hop out of that moving walkway otherwise you will get left behind.

If that is what life is about. Then that is a very limited life. Life can be so much broader than that. The so call life is made up by people who are either not better than you or have their head stuck in schoolbag since they were young. The truth is we are limited by our beliefs more than what the actual present circumstances are.

The world is not a static place where you can’t do anything or anything you do nothing would change. It may not be easy, but there's one simple undeniable fact: that is you can smash things, you can change things, you can create things or influence things mean you can jump out of that so call “life” and create your own life. And many things when it started out often look like a bad idea or to some extend may even look silly to attempt. But that's because one is looking at it in a very narrowed len. Zooming out would let ones see the grand scheme of things and how a small attempt can go a long way. The moment you understand this you can never look life the way as before. But first one has to take his head out of the schoolbag.

Q2 : Are you a full-time or part-time investor at the moment?

A2 : I am a part time investor. No intention of being a full time, anyway it's too early to say that. But, I think even if I have the capital. My time and energy would still better be spent on doing work that makes an impact to myself and others.

Q3 : When (at what age) did you start investing in shares and who has influenced you the most?

A3 : Around 24 I think, but shortly afterward I sold off my stocks as I got accepted in a prop trading firm. The ones that influenced me the most are probably: Benjamin Graham, Tweedy, Browne report on What Has Worked In Investing, Eric Kong’s video on Scientific Approach, Teh Hooi Ling on book $how Me the Money, Tobias from Greedbackd, Howard Mark’s memo on contrarian thinking, Wesley Gray from Alpha Architect, lots of gem. And another recent one is an interview’s video with Cliff Asness from AQR, very insightful discussion on value and momentum investing.

Q4 : Do you view yourself as long-term (holding shares in years), short-term investor (holding shares in days/months) or mixture?

A4 : Long term for sure, I see investing as part of a capital allocation rather than money making activity. It's an ongoing process. The question would probably be what’s the allocation percentage rather time horizon as I would not go all-in neither would I exit completely.

Q5 : What is your basis of selecting the shares to invest (e.g. basing on fundamental analysis, technical analysis or other methods/sources [share a little bit more details if it is the latter])?

A5 : Ah, I think this is the most exciting part of the whole interview. For my current stocks portfolio, I use solely on fundamental analysis. Actually it is based on basic price to fundamental and not much on analysis.

The way I approach my stock investing can be explained by the way how STI works: Simple criteria, portfolio approach and portfolio rebalancing. My approach is based on two big investment hypotheses:

I. Value, the attractiveness of a stock depends on the gap between price and value. The value I define here is solely based on present assets value. No consideration is placed on earnings, management or business. So be it whatever metrics you use to define value. The lower generally yield better performance than the higher. And value stocks as a group tends to outperform the market over long term i.e typical timeframe for outperformance is around 3-5 years.

II. Model outperforms discretionary. A simple and fixed rule like picking a group of low value metrics stocks and periodically portfolio rebalancing would do better than cherry picking and discretionary approach i.e analyzing business, management and etc. Using a systematic approach would prevent investors emotional biases from making sub-optimal investment decision. I do think that discretionary approach would value add to the investment process but it would take decades after decades of temperamental practice. So for the average investors value destroying is the likely outcome.

These two are the two big notions. Maybe I can share 3 more factors:

III. Size. Stocks performance in general. Small cap. tend to outperform big cap. Institutions often shy away from small cap. because of its perceived business risk and may present an investable issue. Media and analysts also tend to cover stocks that appeal most to readers than stocks with investment merit. These result in insufficient or if any media’s coverage on the small cap. The lack of public interest and big players in the small cap mean prices are less efficient. Market efficiency is the key reason why it is hard to achieve above market returns i.e you need to be more right than the big boys. Hence to achieve market beating returns investors should build a portfolio around small cap.

IV. Portfolio rebalancing. The hardest part of stock investing is to know when to sell. Buying is often easy when you have a clear set of criteria. But selling is less straightforward. It seems that selling as a negative connotation attached to it. When the investment value drops below your purchase price, selling means realizing investor’s loss. But when the share price surges. Selling suggests price would not go higher. Selling also means that you are out of the “game.” The common trait of rookie investor is to bluff himself believing that is a trader when prices go up and investor when prices go down. Periodical rebalancing would solve that selling problem.

V. Portfolio approach. The reason of this approach is to reduce the individual business risk at the portfolio level. So the portfolio would have little business exposure (what you don't want) and maintain exposure in value. So you are effectively investing in mispriced assets rather the expectation that the business will grow. For the evidence that I have, on average, investing in mispriced stocks beat winner’s stocks.

So that’s all. The objective is to spend as little time as possible but still achieve market beating returns. By the way, in case you wonder I didn’t make that up. It’s not something I pulled out of thin air. I’m going to reveal this secret: Google “factor investing” if you are interested to read more about it. There’s a report by MSCI.

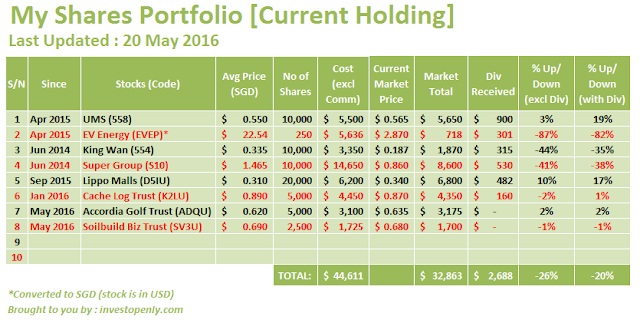

Q6 : What is your targeted and achieved annual rate of returns (%) so far?

A6 : I started my value stocks portfolio since last year January. Based on XIRR is now sitting at 1.35%. I don't have a target rate of return in mind as I don’t believe in going after a percentage of returns. Investment returns are unpredictable. But there is an objective, which is to achieve market beating returns with minimum effort. If I can't do that I would probably just park my money in STI ETF. And I'm glad it has been doing quite well given how little hours I put in.

Q7 : What is your most recommended online investing resource (site or blog) to share with our readers?

But ones have to be mindful about the material you read. As I find that there are plenty of self-reinforcing rhetoric and promotional propaganda in the community. When the market goes on to their favour you’ll see a ton of cheering articles. But when it collapsed, like the end of 2015. Lots of self-reinforcing articles started to appear.

At times it can be informative and encouraging especially when investors’ returns are under the water. But ones have to strike the balance between reading information that is important and those that make you feel good but has no utility.

Q8 : Besides shares, what other investment are you involved in (e.g. Real Estates, Bonds or REITs etc)?

A8 : All are on shares. Other than that I invest quite a lot on knowledge about $100-200 per month on books.

Q9 : What is your Portfolio Distribution like?

A9 : 30% on stocks and 70% in cash.

Q10 : If the readers what to get in touch with you, how to get hold of you? (Sharing of your website/blog/social media profile etc..)

A10 : Oh yea, so you can find me at GiraffeValue.com or connect me at my Facebook page GiraffeValue. My writing is quite infrequent. At the current rate is about 1 post at every two months. If readers would not want to miss any of my posts then do head over to my blog and subscribe it via Email.

Other than that feel free to leave your comment below and I'm happy to answer.

Last but not least, if you are a retail investor and would like to be featured in my "Interview With The Fellow Investors" blog series, please feel free to email me at investopenly@gmail.com.

Also, for the complete list of my interviewees and their posts, check it out

here.

Cheers!