In slightly more than 24 hours time, we will bid farewell to 2015 and welcoming a brand new year. So, I thought it is a good idea to recap some key events/milestones in the year 2015 chronologically. It is not restricted to my investment journey, in fact, as my investment portfolio is still in minion size, it only formed a small part of my year 2015.

My memory is rather poor but luckily I do post quite actively in my Social Media (mainly Facebook) on my major life events, it is a breeze for me to recap my 2015.

Without further ado...let's get started.

Jan 2015

1. I've spent 15 days with wifey in Melbourne Australia, get to know the city slightly better, as my wife will be in and out this very live-able metropolitan city regularly for the new few years or so, I am sure will be back soon. Do check out my earlier post on some key observations in Melbourne. Who know, we might decide to retire there one day? ;-)

|

| Panoramic view from my rented apartment |

Feb 2015

1. Back to my home town to celebrate Chinese New Year and managed to meet with a few secondary classmates (by chance) that we've never met for more than 20 years. Still keep in touch with some of them occasionally via social media. The funny thing is most of them can still recognize me but I can only recall a few of them. That's how "powerful" my memory is.

Mar 2015

1. First anniversary of this blog as well as my Investment Journey. I am still baby as far as my investment portfolio is concerned.

Apr 2015

1. Passing of my beloved mother. She (and my dad) will be forever in my mind.

2. Added UMS (558.SI) and EV Energy Partner (EVEP) to my portfolio.

May 2015

1. Added King Wan (554.SI) to my portfolio.

2. Participated in an half-day volunteer work (for the first time) in distributing rice/bread to the needy. I like the name of the the campaign : From me (米) to you!

|

| From me to you campaign |

Jun 2015

1. Visited St John and Kusu island for the first time and enjoy the serenity of the place.

|

| St John Island |

2. Participated in an half-day volunteer work in distributing rice/bread to the needy (second time).

|

| From me to you volunteer campaign 2 |

Jul 2015

1. Return to Malacca after donkey years for a short weekend getaway. More tourist attractions with a pricier goods and services.

|

| Malacca re-visited |

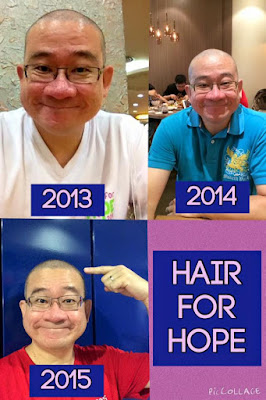

2. Participated in the Hair For Hope charity campaign for the 3rd time. This is how I look like when I am botak :

|

| Hair For Hope 2015 |

Aug 2015

1. Returned to Taiwan for the second time, still love the country and the locals.

|

| Taipei, Taiwan re-visited |

2. Attended the first ever Sports Day of the company and first time playing the human foosball. Tiring but quite fun.

|

| Human Foosball |

Sep 2015

1. Singapore Election and you know who won! ;-)

2. Added Lippo Malls Indonesia Retail Trust (D5IU.SI) to my portfolio

Oct 2015

1. First staycation experience and quite like it.

2. Visited Coney Island, walking distance from my place ;-)

|

| Coney Island |

3. Attended the Purple Parade (a movement that supports the inclusion and celebrates the abilities of persons with special needs) for the second time and get up close with our PM :

|

| Purple Parade 2015 |

Nov 2015

1. The launch of Medishield Life. Why is it related to me is because I am involved in the system enhancement in supporting this product revamp at my company.

Dec 2015

1. First time volunteered myself to bring elderly to visit Trick Eye Museum, Sentosa. Quite an experience in handling the Dos and Don't in approaching the seniors as well as navigating the wheelchair :

|

| Trick Eye Museum with the elderly |

All in all, I am quite happy with my 2015 and I hope 2016 will be even more awesome!

How about you? What is your 2015 like?

How about you? What is your 2015 like?

Cheers!